Dealing with VAT can be confusing and, worst of all, time-consuming - Creating long delays for your parcel to arrive at your front door.

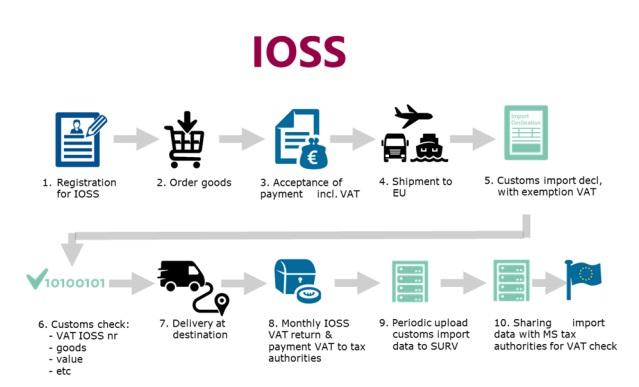

To help provide our customers based in Europe shipping options that both save you time and money, ZenMarket is IOSS registered!

Which means you can prepay VAT for EU parcels when you pay for shipping altogether so you do not have to worry about those complex customs procedure and payments. ZenMarket is your perfect one-stop solution for VAT pre-payment.

Important notice: Starting May 12th, 2025, the tax collected for parcels whose total item price is below EUR150 before shipping will be calculated based on the total amount of items in the parcel + international shipping fee.

Case scenarios:

- Parcel to France (tax rate 20%), item price 4,000 yen, shipping 1,330 yen.

- Before the change → 20% tax on price of items in the parcel: 4,000*0.20=800 yen.

- After the change → 20% tax on total parcel cost: (4,000+1,330)*0.20=1,066 yen.

Notes:

- This change does not affect the EUR 150 threshold. The threshold will remain based on the item value only.

- 140 Euro worth of items in parcel + 40 Euro shipping qualifies for IOSS, but VAT will be applied to 180 Euro total.

- 160 Euro worth of items in parcel + 40 Euro shipping does not qualify for IOSS (same as previously).

Please note that the UK and Norway are not subject to IOSS, which is why the current changes do not apply to them at the moment.

We apologize for any inconvenience this may cause and sincerely thank you for your understanding.

IOSS System Benefits

- Save Money! - A customs clearance fee is usually charged by the transporter when your items arrive at the customs office. With IOSS, parcel transporters don't have to deal with VAT, and therefore, you don't have to pay any clearance fees!

- Faster Delivery! - With IOSS, transporters don't have to deal with preparing VAT documentation and invoicing for your parcels, meaning your items arrive at your doorstep even faster!

We cannot automatically process taxes for Parcels that contain a total value of 150 EUR or more.

And the IOSS system is not available for parcels sending to the United Kingdom and Norway.

Therefore goods valued above 150 euros or not eligible for IOSS will need to be processed and charged by customs offices domestically within Europe.

Please note that even though VAT is paid, depending on the items ordered and the individual country's import policies, Custom Duties might be required for parcel delivery.

VAT For Parcels Over 150 EUR

Due to changes in EU import VAT rules starting July 1st, 2021, customers shipping goods valued over 150 EUR to the EU via courier services, can now submit their tax identification information for smoother customs procedures.

The type of information necessary depends on the value of the goods in the parcel and the destination country including, but not limited to:

- Tax ID

- EORI Number

- Social Security Number

The information can be submitted on ZenMarket via the "Taxpayer Identification Number (TIN)" field at the bottom of your address when creating a parcel (the name of this field may be updated in the future).

Below is the information available as of July 2021 for personal consumer. Please kindly note this information might be updated by the respective country's authorities at any time.

Please investigate which type of information is necessary for your package based on importing purpose in advance to ensure that your parcels are processed by your country's customs office without delay.

| Country |

Goods value [Below €150] (Goods value)

*IOSS option selected

|

Goods value [Above €150] (Goods value)

|

| Austria |

Automatically Processed* |

- |

| Belgium |

Automatically Processed* |

- |

| Bulgaria |

Automatically Processed* |

EORI Required |

| Croatia |

Automatically Processed* |

- |

| Republic of Cyprus |

Automatically Processed* |

- |

| Czech Rep. |

Automatically Processed* |

EORI Required |

| Denmark |

Automatically Processed* |

- |

| Estonia |

Automatically Processed* |

Social Security Number required |

| Finland |

Automatically Processed* |

Social Security Number (or) EORI required |

| France |

Automatically Processed* |

- |

| Germany |

Automatically Processed* |

If more than 9 imports per year, EORI required |

| Greece |

Automatically Processed* |

If above €1,000, TAX ID required |

| Hungary |

Automatically Processed* |

If above €1,000, TAX ID required |

| Ireland |

Automatically Processed* |

- |

| Italy |

Automatically Processed* |

TAX ID required |

| Latvia |

Automatically Processed* |

Social Security Number required |

| Lithuania |

Automatically Processed* |

If above €1,000, EORI required |

| Luxembourg |

Automatically Processed* |

- |

| Malta |

Automatically Processed* |

- |

| Netherlands |

Automatically Processed* |

- |

| Poland |

Automatically Processed* |

- |

| Portugal |

TAX ID (if VAT is levied at import and paid by consignee) required |

TAX ID required |

| Romania |

Social Security Number (or) EORI required |

Social Security Number (or) EORI required |

| Slovakia |

Automatically Processed* |

National ID required |

| Slovenia |

Automatically Processed* |

TAX ID required |

| Spain |

Automatically Processed* |

TAX ID required |

| Sweden |

Automatically Processed* |

- |

*No additional information is required to be submitted when sending a parcel of this value to this country as VAT will automatically be calculated.

We hope this information has been helpful in providing clarity on how the new rules and proceedings implemented by the EU may affect some ZenMarket customers.

VAT for the United Kingdom

Import tax collection has been introduced on March 30th, 2022 for packages bound for the United Kingdom.

- For Parcels valued under 135 Pound Sterling (Goods value) or less, you can pre-pay the cost of VAT along with international shipping if you choose to.

- For Parcels valued over 135 Pound Sterling, VAT will be collected at the point of import.

- The value-added tax rate is 20%.

VAT for Norway

VOEC VAT for Norway:

- The tax can be optionally pre-charged if each individual item is no more than 3,000 NOK. (If there is at least 1 item that costs 3,000 NOK or more, we cannot pre-charge the tax for you.)

- Total parcel value does not matter; what matters is whether each item in the parcel is within the price limit.

- The value-added tax rate is 25% under the VOEC scheme (include items + shipping in total)

How Much VAT Do I Need To Pay?

How much you will be charged for VAT will depend on the country you are trying to import your goods to. In general the rates are between 15% to 27%.

You can search for most updated VAT Rates for your country in this Tax Database. You can also refer to our help page for Frequently Asked Questions.

| Country |

Standard VAT Rate (Goods value %) |

| Austria (AT) |

20% |

| Belgium (BE) |

21% |

| Bulgaria (BG) |

20% |

| Croatia (HR) |

25% |

| Cyprus (CY) |

19% |

| Czech Republic (CZ) |

21% |

| Denmark (DK) |

25% |

| Estonia (EE) |

22% |

| Finland (FI) |

24% |

| France (FR) |

20% |

| Germany (DE) |

19% |

| Greece (GR) |

24% |

| Hungary (HU) |

27% |

| Iceland (IS) |

24% |

| Ireland (IE)* |

23% |

| Italy (IT) |

22% |

| Latvia (LV) |

21% |

| Lithuania (LT) |

21% |

| Luxembourg (LU) |

17% |

| Malta (MT) |

18% |

| Netherlands (NL) |

21% |

| Norway (NO) |

25% |

| Poland (PL) |

23% |

| Portugal (PT) |

23% |

| Romania (RO) |

19% |

| Slovakia (SK) |

20% |

| Slovenia (SI) |

22% |

| Spain (ES) |

21% |

| Sweden (SE) |

25% |

| Switzerland (CH) |

8.1% |

| Turkey (TR) |

20% |

| United Kingdom (GB) |

20% |